Your cart is currently empty!

Blog

XRP Is Not Dead, It’s Just Loading: Analyst

A popular social media influencer explained why XRP might be a sleeping giant.

4 Good Signs for Bitcoin Prices in May With $100K Back in View

Bitcoin prices were a big loser at the end of Q1, after soaring to a record high in January and posting world-class market gains in Q4, 2024. But April turned out different at the end.

Crypto X Analyst Spots ‘Big Breakout’ for Ethereum

Converging trend lines in this ETH chart technical analysis indicate grounds for a bullish break to the north. That’s a potential opportunity, as Vitalik Buterin outlines the 2025 roadmap for Ethereum.

Crypto X Chart Analyst: Dogecoin Swing Pattern Could Top $0.8 By August

Can DOGE defy the market sentiment and surge to a new all-time high?

Did a $330 Million Scam Fuel Monero’s (XMR) 50% Price Surge? (ZachXBT Weighs In)

The 3,520 BTC heist triggered a 50% Monero price spike as thieves converted funds through privacy coin’s illiquid markets.

TL;DR

- Ripple’s native token became one of the biggest gainers after the US elections, but lost some steam in Q1, even though the company’s lawsuit against the SEC is seemingly over.

- Although no one has actually declared it dead (at least not in the well-known public space), a social media influencer with over 500,000 followers on X explained why it could be just loading.

Not Dead, Just Loading

John Squire started with a 10-year setup that investors might have ignored until now. Ever since the project’s establishment around a decade ago, the company behind it has made big moves to enhance adoption. Squire said RippleNet is used in over 55 countries, while some of its notable partners include SBI, Tranglo, and Santander.

As such, he noted that XRP isn’t some “new hype coin. It’s been quietly building since before most influencers discovered Bitcoin.”

He touched upon the prolonged battle between Ripple and the US securities regulator, which dragged on for over four years. Although the SEC has yet to confirm that the case is closed, Ripple’s CEO triumphantly announced it in mid-March. Squire said, “XRP is the only top 10 coin to fight the US government and survive.”

In terms of institutional adoption and the possibility of a spot Ripple ETF in the States, the social media influencer outlined the XRP futures product prepared to be launched by CME this month, as well as the 10 applications sitting on the SEC’s desk. Although the Commission delayed making a decision on one of them earlier this week, many experts believe it’s just a matter of time before XRP follows the example set by ETH and BTC last year.

Institutional money is knocking

CME launching XRP futures in May 2025

Wall Street wants in

Rumors of BlackRock XRP trust won’t die

This isn’t retail buzz. This is big money warming up.

— John Squire (@TheCryptoSquire) May 1, 2025

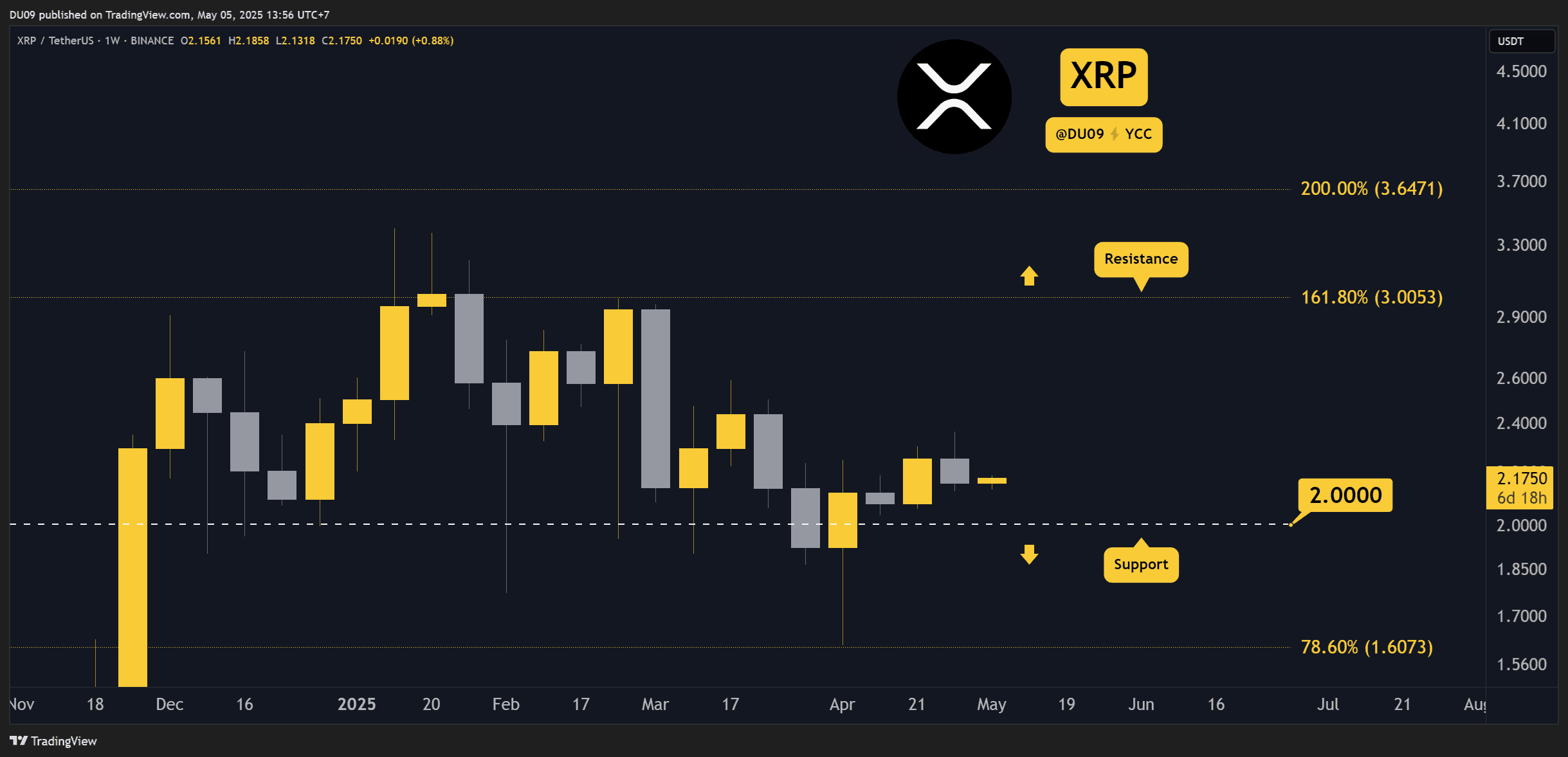

XRP Price Chart Says Bull Run

Echoing another report that XRP might skyrocket in the following month(s), Squire said the asset’s chart paints a clear bullish picture. Aside from a few brief fluctuations below $2, the fourth-largest cryptocurrency has mostly remained steady above that line ever since it broke it in late 2024.

Squire added that the RSI is cooling off and the volume is “quietly building. Smart money doesn’t chase pumps. It buys when you are bored,” he added. There’s certainly some proof for that, as whales accumulated nearly $2 billion worth of XRP in April alone. Additionally, whale addresses have skyrocketed to a record of their own above 300,000.

After the mandatory disclaimer that his post is not financial advice, Squire concluded that the most hated assets, such as XRP, often outperform.

The post XRP Is Not Dead, It’s Just Loading: Analyst appeared first on CryptoPotato.

Crypto Hacks Surged to $92.5M in April 2025: Immunefi

Ethereum and BNB Chain bear the brunt, representing 60% of April’s hacks, with Base emerging as a new hacker target with a 20% share.

BTC tumbled from $109K on Jan. 21 to find support at $75K in late March. Then, after a final bear test above $75K on Apr. 9, bulls came roaring back to close out April above $95K.

Trump Scare, Massive BTC Rally Repeat?

One popular Crypto X analyst noticed in April a familiar pattern in Bitcoin’s price rebound following the sell-off after the coronavirus shock.

Global financial markets are back to placing bets after pulling their cash in during the Trump second term and tariff panic. Major participants in the Bitcoin economy may be seeing similarities between now and the last time Trump started pushing Fed Chair Jerome Powell for interest rate cuts.

The last time this happened, Bitcoin grew 12 times in market prices in 24 months.

Crypto Markets Feeling Bullish Again

That’s an average annualized ROI of 550% from 2019 to 2021. For comparison, the S&P 500 Index delivered an average yearly ROI of 10% since 1957.

It’s no wonder institutions are bullish on the original blockchain cryptocurrency.

Even the doctor of Bitcoin doom himself, EuroPac’s Peter Schiff, made a big about-face in a tweet storm on X, asking followers to donate BTC to him that he promises he will never sell.

For anyone who’s been keeping the score with Schiff’s anti-crypto texts, this is some kind of bizarro world.

Here are four reasons the little currency is looking so good for crypto bulls in May.

1. Wall Street Bitcoin ETFs Insatiable in April

Updated my Bitcoin ETF Chart pack today on Bloomberg. The ETFs have taken in nearly $4 billion on 8 consecutive days of inflows. Here’s what the cumulative flows have looked like over time: pic.twitter.com/euWt9TGjhA

— James Seyffart (@JSeyff) April 30, 2025

The entry of Wall Street buyers via Bitcoin ETFs pushed BTC prices up for almost all of 2024. Institutional investors also delivered massive capital inflows to MicroStrategy (now Strategy) and Bitcoin miners in 2023, signaling pent-up demand.

Now that stock traders are a tidal force on the cryptocurrency economy, Bitcoin ETF inflows and outflows respond to and affect the asset’s price. Manhattan markets flipped wildly bullish for BTC in April.

Bitcoin ETFs saw uninterrupted daily inflows from Apr. 17 to Apr. 29, a couple of times verging on a billion dollars for the day’s trades.

#Bitcoin Etf inflow is at the top of 2025.

Some knows something good pic.twitter.com/ynyn3KbSi3— Alpha Whale Crypto (@AlphaWhale_) May 1, 2025

By Apr. 28, Bitcoin ETFs saw $3.06 billion in total weekly inflows, the second-highest on record.

Meanwhile, Bitwise chief investment officer Matt Hougan wrote in a note to investors that he expects ETF flows to continue to expand sustainably.

“I still expect bitcoin ETFs to set a new record for net inflows this year,” Hougan said, “despite pulling in ‘just’ $3.7 billion so far in 2025, compared to $35 billion in 2024.”

2. Semler Scientific Buys $15.7M BTC

In addition to the high demand for Bitcoin exchange-traded funds by investors, corporations continue to ramp up the global race to stockpile Bitcoin. That limits the supply available on exchanges and pushes the price up further.

Virginia-based Strategy started off this incredible demand for BTC to shore up its balance sheets. It works as an inflation shelter, macro hedge, and a way to increase returns on investment when the asset has a good year.

On Apr. 30, California-based health care tech company Semler Scientific announced a 165 BTC buy for around $15.7 million. Semler reported:

“As of April 29, 2025, Semler Scientific held 3,467 bitcoins, which were acquired for an aggregate $306.1 million at an average purchase price of $88,263 per bitcoin, inclusive of fees and expenses and had a market value of $330.6 million…”

When Semler first started buying BTC last May, its stock surged 38% as a result.

Meanwhile, Strategy made another billion-dollar Bitcoin buy announced on Apr. 28. That brings its total holdings to 553,555 BTC acquired for an average of $68.5K per BTC.

3. Arizona Moves to Stockpile Bitcoin

It’s not just US corporations piling on Bitcoin. Following in the lead of the White House initiative to establish a national reserve, several states are moving to add the asset to their books.

In April, Arizona joined them with a move by the legislature to establish a state Bitcoin reserve. That leaves the matter in the hands of a governor, who could sign one into law with a pen stroke any day now.

“Crypto and bitcoin have a huge following nationwide and in Arizona,” said Arizona state Sen. Wendy Rogers, who co-sponsored the bill. “They are wildly popular with the youth and independents.”

This is the first state legislative approval to establish a BTC reserve. While several states are seriously exploring it, the Copper State may just kick off a rush in other statehouses.

4. Bitcoin Whales’ Big Buying Spree

Cryptocurrency markets are nothing without their whale-sized traders. Big moves by these behemoth investors tend to forecast future price moves because the big money has incentives and resources at scale to make smart bets.

As a result, whale splashes in the Web3 liquidity pools can cause future movements in market prices and become self-fulfilling prophecies.

That’s good news for BTC sellers and long-term holders. Bitcoin whales went on a massive accumulation binge in April. In the final two weeks of the month, they bought $4 billion.

That strong support from both Wall Street institutional buyers and Internet retail buyers is very bullish for the cryptocurrency’s outlook.

The post 4 Good Signs for Bitcoin Prices in May With $100K Back in View appeared first on CryptoPotato.

3 Things That Could Rattle Crypto Markets This Week

A busy week lies ahead on the United States economic calendar, and all eyes are on the Federal Reserve.

Ethereum’s price was down 2.9% for the 1-month view to start the weekend. But it was down even more, by -38%, over the 1-year view.

That could be a buying opportunity for cryptocurrency investors and altcoin traders to scoop some Ether tokens at a discount. In fact, one popular Crypto X analyst recently pointed out that Ethereum’s price chart exhibits a potential bullish breakout up ahead.

Crypto Analyst Checks Ethereum Price Falling Wedge

MN Fund founder Michaël van de Poppe wrote in an update on Wednesday, Apr. 30:

“$ETH is consolidating before a big breakout upwards. The liquidity is up for grabs, it just needs a news related item to kick it off.”

$ETH is consolidating before a big breakout upwards.

The liquidity is up for grabs, it just needs a news related item to kick it off. pic.twitter.com/VQaGvfZcA0

— Michaël van de Poppe (@CryptoMichNL) April 30, 2025

De Poppe then shared a TradingView screen grab of descending wedge lines with steeper lines of resistance and flattening lines of support. This is a classic chart indicator of a bullish reversal from a downward trend.

It is an especially suggestive indicator in this case because it has the textbook declining daily trade volume as the trend lines converge.

Vitalik Buterin New Ethereum Roadmap for 2025

One commentator replied to van de Poppe:

“Yeah that ETH chart’s wound tighter than a drum rn. Consolidation screams pre-breakout vibes. Just need that catalyst like you said. What kinda news are we realistically looking for tho?”

Ethereum founder Vitalik Buterin’s new 2025 roadmap for the cryptocurrency may pull its community back together.

The number two ranked cryptocurrency by total market cap has been in a price doldrums on Bitcoin’s current multi-month upswing. But that doesn’t mean it’s all over for Ethereum yet.

The leading smart contract altcoin has seen price growth deflate while several L2s grew vastly in market cap since the Dencun Upgrade in Mar. 2024.

These Layer 2 zip file style solutions to speeding up Ethereum have been making most of the percentage gains because that’s what the new incentive structure rewards.

The same day as his Ethereum falling wedge update, van de Poppe reminded followers the extreme bearish sentiment on many altcoins at the moment is a window of opportunity to capture ROI when the market turns again.

The next leg upwards is on the horizon for the #Crypto markets.

The bearish sentiment remains extreme on #Altcoins and that’s an ideal ingredient for the next leg up.

— Michaël van de Poppe (@CryptoMichNL) April 30, 2025

The post Crypto X Analyst Spots ‘Big Breakout’ for Ethereum appeared first on CryptoPotato.

Vitalik Buterin Proposes Making Ethereum as Simple as Bitcoin

The Ethereum co-founder wants to simplify the layer-1 network and make it as simple as Bitcoin for long-term success, resilience, and scalability.

A Crypto X chart technical analyst just pointed out a pattern in Dogecoin’s price that could mean the meme coin is the underdog in crypto markets at the moment.

Crypto Chart Trader Gives Dogecoin Thumbs Up

#Dogecoin consistently finds support at previous swing highs. It just rebounded from support matching a previous swing high.$DOGE may have completed its pullback and could surge again soon pic.twitter.com/dhfnblpj3v

— Trader Tardigrade (@TATrader_Alan) April 30, 2025

Crypto chart pattern analyst “Trader Tardigrade” told followers in an Apr. 30 post on X that “[Dogecoin] consistently finds support at previous swing highs.”

“It just rebounded from support matching a previous swing high,” Trader Tardigrade added. “[DOGE] may have completed its pullback and could surge again soon.”

$DOGE Huge Price Projection Target

Dogecoin is now entering its 3rd wave of upwards momentum, potentially aiming for a 740% price increase.

Next Price Target : 1.10$ per $DOGETrade $DOGE NOW on #BYDFi !

Get a 15% Cashback up to $1000 when you sign up and deposit on BYDFI… pic.twitter.com/JW0jj3scmi— Bitcoinsensus (@Bitcoinsensus) May 1, 2025

The last time Dogecoin found support at the previous swing high level, support was in Q3 last year at Q4 2023’s swing high level. From there, the meme coin catapulted to the upper resistance line of its broader, multi-year trend channel.

According to Trader Tardigrade’s chart, if Dogecoin follows its previous pattern, the price will begin a steep rally as high as $0.80 per DOGE before August.

New All-Time High For DOGE Tokens?

#DOGECOIN road to $10!

If you’re still holding $Doge, you’re an absolute legend. pic.twitter.com/ZppO6UTzSK

— STEPH IS CRYPTO (@Steph_iscrypto) May 1, 2025

Dogecoin prices have been cooling down ever since a moonshot to $0.46 in December. That price surge followed the pattern the chart analyst describes for DOGE’s graph.

The lovable meme coin’s price has historically followed the pattern of reversing at recent swing high levels. DOGE found decisive support there in April. So a breakout to markedly higher levels could be ahead.

DOGE hasn’t had the past 12 months that BTC has, but over enough time, it has historically had periodic flash rallies. Prices go up by shocking percentages, as in Spring 2021 and Winter 2024.

Popular Bitcoin analyst Muro Crypto recently reminded followers, “Once DOGE starts pumping, it would be the official signal for a legit altseason, it’s always been the altseason indicator.”

The post Crypto X Chart Analyst: Dogecoin Swing Pattern Could Top $0.8 By August appeared first on CryptoPotato.

Ripple (XRP) Price Predictions for This Week

XRP is moving sideways with market participants undecided on where to go next. XRP Price Predictions to Watch This Week Key Support levels: $2, $1.6 Key Resistance levels: $2.3, $2.6, $3 1. Buyers Hesitate In the past few weeks, XRP failed to move away from the key support at $2 and is found around $2.17 […]

The US central bank will announce its interest rate decision this week, and it is highly expected that things will remain the same.

Optimism picked up a little last week as stock and crypto markets made gains as tariff concerns eased slightly.

However, the unexpected Q1 GDP contraction shook market sentiment. This appears to be the result of companies front-loading orders ahead of anticipated tariffs.

It was also reported that President Trump has no plans to speak with China’s President Xi this week. In a potential escalation of trade tensions, Trump said that Beijing is “ripping us off” and Chinese and US officials are talking about “different things.”

Economic Events May 5 to 9

Consumer sentiment also fell in April for the fourth month in a row. It is now back to levels not seen since the pandemic era, as households brace for further price hikes.

On Monday, April’s ISM Services PMI (purchasing manager’s index) report will be released, reflecting business conditions in the US services sector. This key leading indicator helps analysts anticipate shifts in economic momentum.

April’s S&P Global Services PMI is also due on Monday and offers an alternative perspective on the services sector by including a wider spectrum of private-sector firms.

A Consumer Credit Change report is due Wednesday, measuring monthly changes in how much consumers are borrowing to finance spending on goods and services.

The Federal Reserve will make its decision on interest rates on Wednesday, May 7, and the CME Fed Watch tool shows a 96% probability of rates remaining unchanged at 4.25% to 4.5%.

“We expect Powell to push back against market pricing and signal a renewed priority on price stability,” said Bloomberg analysts. Traders are now expecting 80 basis points of rate cuts this year starting in July, reported Reuters.

Key Events This Week:

1. S&P Global Services PMI data – Monday

2. ISM Non-Manufacturing PMI data – Monday

3. Fed Interest Rate Decision – Wednesday

4. Fed Press Conference – Wednesday

5. Initial Jobless Claims data – Thursday

6. ~20% of S&P 500 companies report earnings…

— The Kobeissi Letter (@KobeissiLetter) May 4, 2025

Four of the Magnificent 7 are scheduled to report results this week: Microsoft and Meta Platforms on Wednesday, and Apple and Amazon on Thursday.

Meanwhile, gold prices increased on Monday, helped by a weaker dollar, as investors awaited more clarity on trade policy.

Crypto Market Outlook

Following a weekend of stability, crypto markets started to tank on Monday morning in Asia, with total capitalization shrinking by 3.3% in a fall back to the $3 trillion mark.

Bitcoin slid below $94,000, its lowest level this month, following a 2% decline on the day. Ethereum had fallen back below $1,800, and many of the altcoins were deeper in the red as markets start the week on shaky ground.

The post 3 Things That Could Rattle Crypto Markets This Week appeared first on CryptoPotato.

ECB’s Digital Euro Project Taps COTI as Pioneer Partner

COTI’s price hasn’t reacted to the big news, yet.

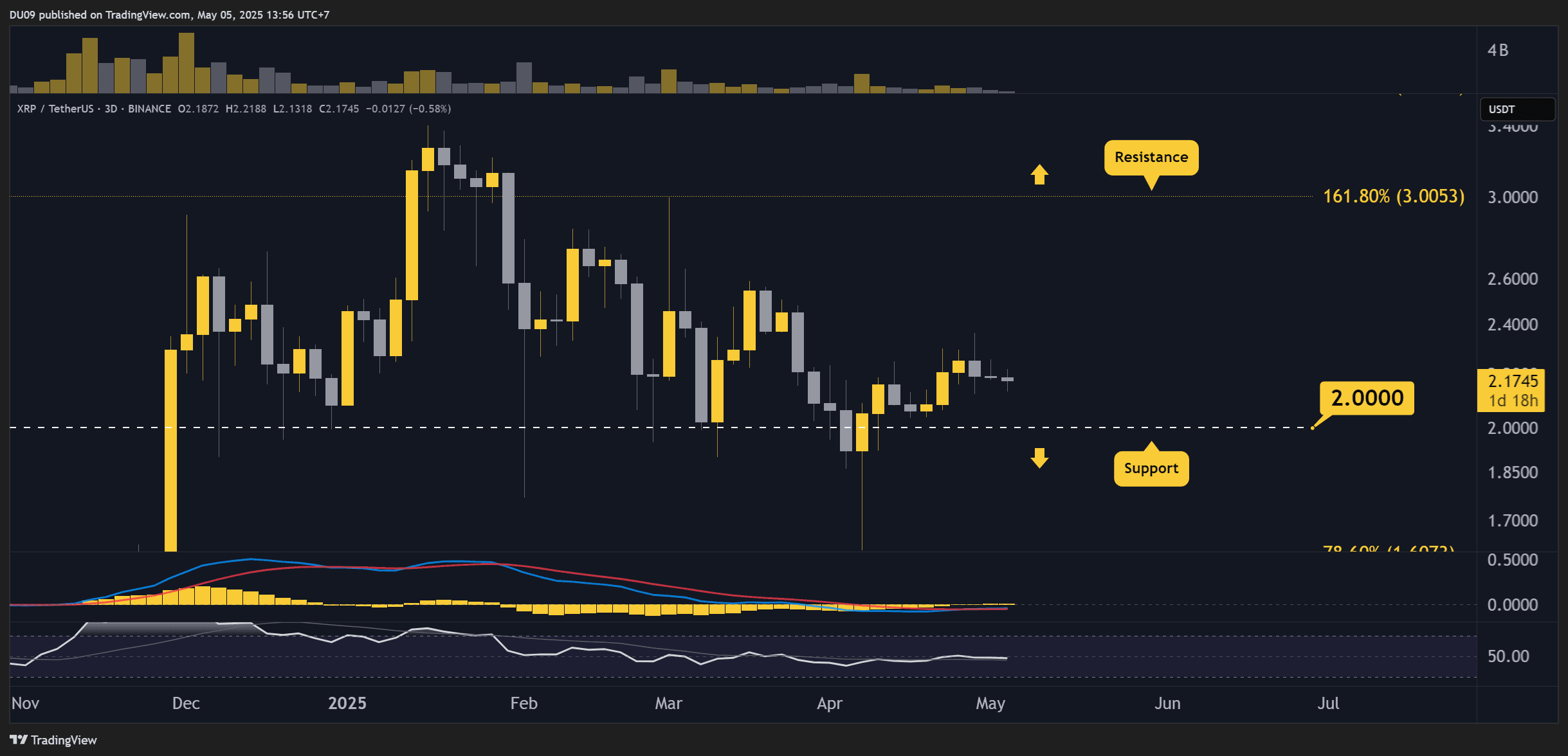

XRP is moving sideways with market participants undecided on where to go next.

XRP Price Predictions to Watch This Week

Key Support levels: $2, $1.6

Key Resistance levels: $2.3, $2.6, $3

1. Buyers Hesitate

In the past few weeks, XRP failed to move away from the key support at $2 and is found around $2.17 at the time of this post. Buyers are absent and any attempt at pushing this cryptocurrency higher is quickly met by sellers. This is a sign of weakness.

Chart by TradingView 2. Another Rejection at $2.3

Last Monday, the bulls tried to break the resistance at $2.3, but they were quickly stopped. Since then, the price has been moving lower and is approaching the key support. If nothing changes, buyers will have another chance to show up at $2 to reverse this downtrend.

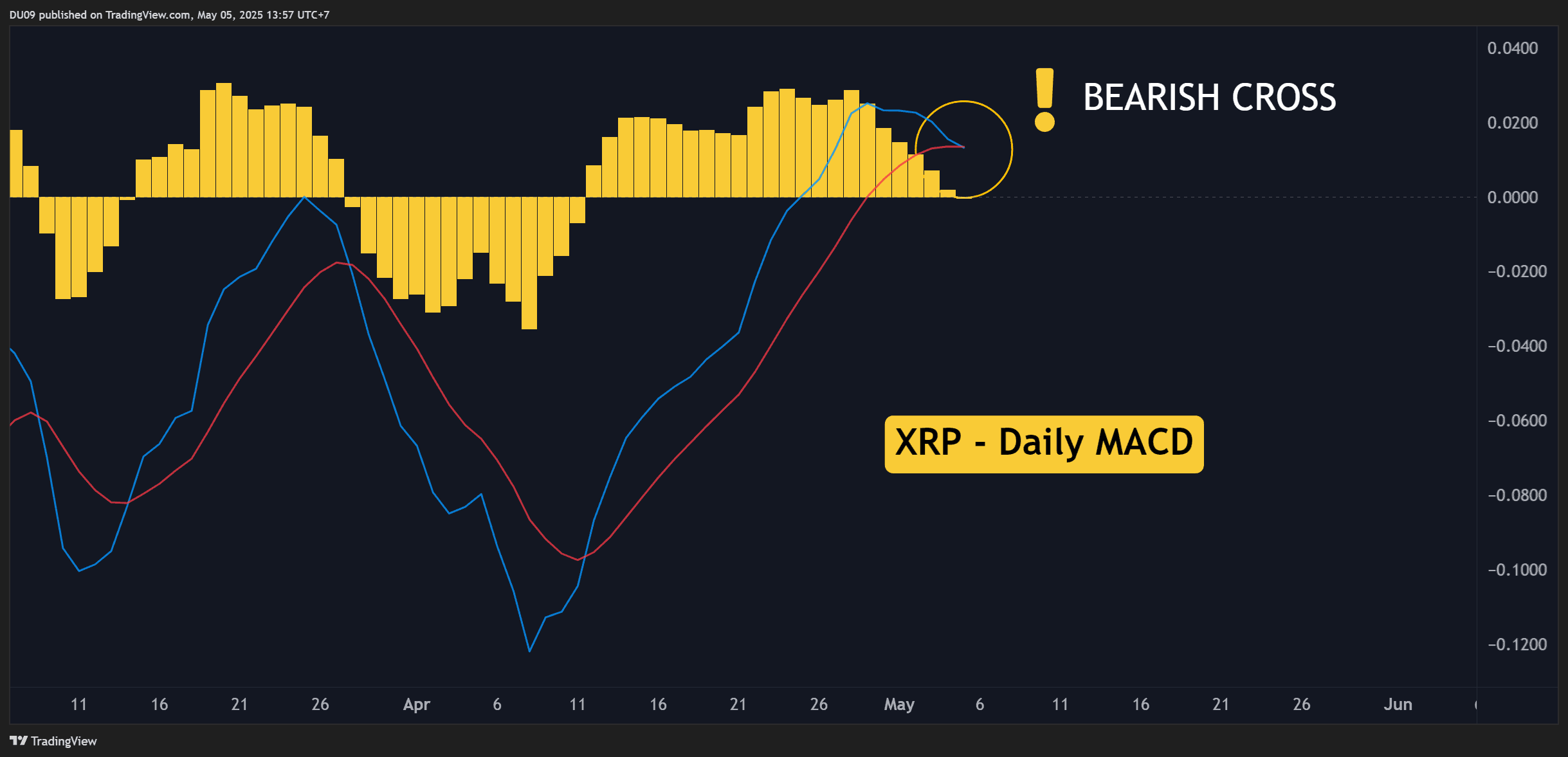

Chart by TradingView 3. MACD Weakness

The daily MACD just did a bearish cross. This is unfortunate and shows the bullish momentum is absent. It also encourages sellers to push the price lower and attempt to break the $2 support. A loss of this key level would turn the chart bearish in the short to medium term.

Chart by TradingView The post Ripple (XRP) Price Predictions for This Week appeared first on CryptoPotato.